You are about to enter a website hosted by an organization separate from USALLIANCE. Privacy and security policies of USALLIANCE will not apply once you leave our site. We encourage you to read and evaluate the privacy policy and level of security of any site you visit when you enter the site. While we strive to only link you to companies and organizations that we feel offer useful information, USALLIANCE does not directly support nor guarantee claims made by these sites.

USALLIANCE Blog

What is a share certificate? A share certificate is an insured savings account, typically with a fixed dividend rate through a fixed date of maturity. A share certificate from a credit union is similar to a certificate of deposit, or CD, from a bank. These accounts offer highly competitive rates by locking your funds into a fixed term. For example, USALLIANCE offers Certificate Accounts ranging from 3 to 60 months in term. The rate is different for different term lengths, but you can choose the rate and term combination that works the best for your financial situation.

Read More

Your Complete Guide to Holiday Shock Recovery

on February 5, 2024

| Spend

The holidays are long past and the new year is now in full swing. However, some of us may still be struggling to get back to everyday life and recover from “holiday shock”. We all know the feeling – the house is in disarray, your daily routine has been out of whack for weeks, and then those first post-holiday credit card statements come haunting you like the ghosts of purchases past! After the time off work and gathering with family and friends over the holidays, it can be quite jarring to get back to our normal lives. Even after a few weeks, you may still be seeing the residual effects of the holidays. The good news is, USALLIANCE is here to help you recover from your post-holiday slump! By making a plan and focusing on a few key areas, you can get back on track in no time and give your 2024 goals your all.

Read More

Infographic: A Timeline of Recent Changes for Student Loans

on January 25, 2024

| Borrow

When the coronavirus pandemic was at its height, many faced financial hardship due to layoffs, an inability to do their job, economic uncertainty, and a host of other reasons. One of the responses to these hardships was a forbearance, or temporary pause, on student loan repayments enacted by the federal government. While that initial decision went into effect almost four years ago in March 2020, there have been various plans, proposals, decisions, setbacks, and successes that have occurred since then. Our infographic traces the timeline of changes that have taken place in the world of student loans since March 2020, through the end of 2023 and provides a look ahead to 2024, when another change will occur.

Read More

Five Career Goals to Set for the New Business Year

on January 17, 2024

| Earn

Most of us make New Year’s resolutions that are personal like improving financial wellness, getting organized at home, or exercising more (ok, that one might seem like an annual resolution, but this is the year). Well, the new year is here and now is the perfect time to take stock of your career and set some professional resolutions as well! Setting well-defined and achievable objectives can help you reach new levels of success and growth in your career. These suggested resolutions are broad, so it’s important to pay attention to the details and tailor them to your situation when you’re making your own list. A good approach is to make sure you’re creating SMART goals – that is, goals that are:

Read More

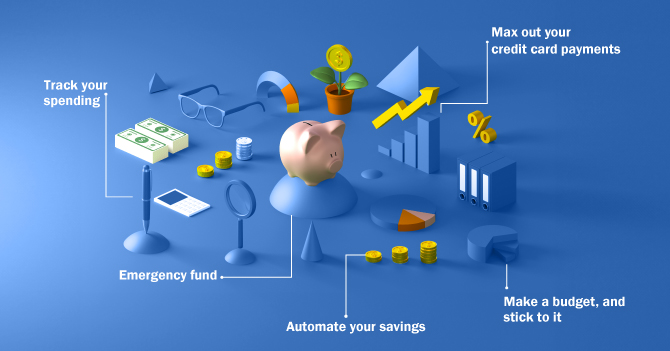

Infographic: 5 Financial Resolutions for the New Year

on January 5, 2024

| Save and Invest

Having New Year’s resolutions centered around finances is very common, and for good reason. There are few aspects of life that financial wellness doesn’t affect, so prioritizing your financial health is a great place to start your new year. This infographic touches on five financial resolutions to set you on the path to financial wellness for 2024:

Read More

What to Buy and What to Skip in January

on January 2, 2024

| Spend

What’s your January shopping style – all shopped out, or ready to hit the mall again as soon as the last guest leaves? January begins with a bang, but there are no major shopping holidays once the new year gets going. That may come as a relief, especially if you were extra generous this year and splurged a bit during the holidays, but you can still pick up great bargains this month if your shopping stamina is still going strong. If you feel like you’re always missing out on the best deals while your friends constantly boast about the rock-bottom prices they’ve paid, we can help! We’ve researched the ebbs and flows of retail throughout the year to identify which items you should have on your list for the first month of the year. Here’s what to buy and what to skip in January.

Read More

3 Common Money Mistakes People Make

on November 20, 2023

| Learn

Everyone wants to manage their money responsibly, but many people often make mistakes in the ways they handle money – without even realizing it. They may have fallen into a bad habit they can’t shake off, or they may be misinformed or less educated in a certain area. The good news is harmful behaviors can always be unlearned and changed. Let’s explore three common money mistakes and review practical solutions for overcoming them.

Read More

Building Financial Resilience: Strategies for Overcoming Financial Stress

on October 24, 2023

| Personal Finance

In today's fast-paced world, we find ourselves juggling multiple responsibilities, facing unique financial challenges, and grappling with the relentless pressure to cover day-to-day expenses while also saving money. As life's expenses continue to rise, maintaining financial stability becomes increasingly daunting. However, despite the inherent hurdles, it is entirely possible to overcome financial stress and lead a financially secure life. Let's explore key strategies for building financial resilience and reducing financial stress.

Read More

A Young Adult’s Guide to Banking on Your Own

on September 14, 2023

| Bank

Many of us begin our financial journey with an account linked to our parent or guardian’s checking account so that they can teach us lessons and keep an eye on our spending. But sooner or later, the time comes for everyone to step out on their own and start their personal financial journey. While this is an exciting and empowering moment, it can also be daunting – there’s a lot to know, a lot to learn, and many potential pitfalls along the way. Don’t worry, USALLIANCE is here to help! This guide to banking on your own will give you some great tips and advice to build a strong foundation for financial independence.

Read More

Mastering Your Finances: A Guide to Managing Cash Flow

on August 16, 2023

| Personal Finance

Financial stability is a critical aspect of life, and it has arguably never been more important – or more difficult to attain – than today. Managing cash flow and building a robust personal portfolio are key factors that contribute to long-term financial success. In this guide, we will explore practical strategies and essential tips to help you take control of your finances and make informed decisions about your personal portfolio. Whether you're a recent graduate just beginning your financial journey or you’re simply looking for to improve your financial outlook, these insights will empower you to create a strong financial foundation for your future.

Read More

current_page_num+2: 10 -