You are about to enter a website hosted by an organization separate from USALLIANCE. Privacy and security policies of USALLIANCE will not apply once you leave our site. We encourage you to read and evaluate the privacy policy and level of security of any site you visit when you enter the site. While we strive to only link you to companies and organizations that we feel offer useful information, USALLIANCE does not directly support nor guarantee claims made by these sites.

USALLIANCE Blog

March is National Reading Month, and we’re kicking off the month with a list of books that can help you improve your financial literacy skills. Whether you’re just starting your financial journey or looking to refine your money management strategies, these books offer valuable insights that can transform the way you think about and handle your finances.

Read More

How to plan your dream wedding without breaking the bank

on February 15, 2026

| Personal Finance

Your wedding day should be about love and celebration, not financial stress. According to The Knot , the average wedding costs $33,000, with each guest adding roughly $284 to the bill. Those numbers can feel overwhelming, but the good news is: you don't need to spend a fortune to have a beautiful wedding. With thoughtful planning and smart priorities, you can have the day you've dreamed of without going into debt or emptying your savings account.

Read More

Infographic: 5 Smart ways to protect your debit card

on February 1, 2026

| Personal Finance

Debit cards are staples in our everyday lives. They’re great for managing spending, making online payments, and avoiding debt or interest fees. However, they shouldn’t be used for every single purchase.

Read More

Infographic: The benefits of using mobile payments

on January 10, 2026

| Learn

Mobile payments are quickly becoming the go-to way to pay—and for good reason. With smartphones now a part of everyday life, digital wallets offer a faster, safer, and more convenient checkout experience.

Read More

4 ways to recover from a post-holiday spending hangover

on January 1, 2026

| Personal Finance

The decorations are down, the gifts are unwrapped, and your credit card statement just arrived. If you're feeling that familiar pit in your stomach when you see the damage from holiday spending, you're not alone. The average American overspends during the holidays, and January often brings a financial reckoning. On the bright side, the post-holiday spending hangover doesn't have to derail your entire year. Here are four ways to get your finances back on track.

Read More

What is the friendship tax?

on December 20, 2025

| Personal Finance

We all know the feeling. Your phone buzzes with plans for dinner, drinks, a concert, or a weekend getaway. Your heart says yes, but your bank account says, "absolutely not." That's what we call the friendship tax: The often-unspoken cost of maintaining an active social life that's quietly draining bank accounts and creating financial stress for many young adults.

Read More

Infographic: 8 Ways online retailers push us to overspend

on December 15, 2025

| Spend

Online shopping makes life easier, but it also comes with clever tactics designed to make us spend more than we planned. With limited-time offers and personalized recommendations, retailers know exactly how to capture our attention (and our wallets). Our infographic breaks down eight common strategies so you can recognize them, stay in control, and keep your budget on track.

Read More

Holiday gifts that help kids and teens build money skills

on December 10, 2025

| Personal Finance

This holiday season, consider giving the young people in your life something that helps them build lifelong money skills. Whether they’re just starting to understand the value of a dollar or ready to learn about budgeting and saving, there are plenty of fun, age-appropriate ways to make financial literacy part of your holiday giving. Here are some ideas to get you started.

Read More

USALLIANCE 2025 Wrapped

on December 1, 2025

| USALLIANCE News & Events

It’s that time of year! As we look back on 2025, we’re celebrating the moments, milestones, and wins that defined our year. We stayed busy in 2025! Here’s your 2025 USALLIANCE Wrapped:

Read More

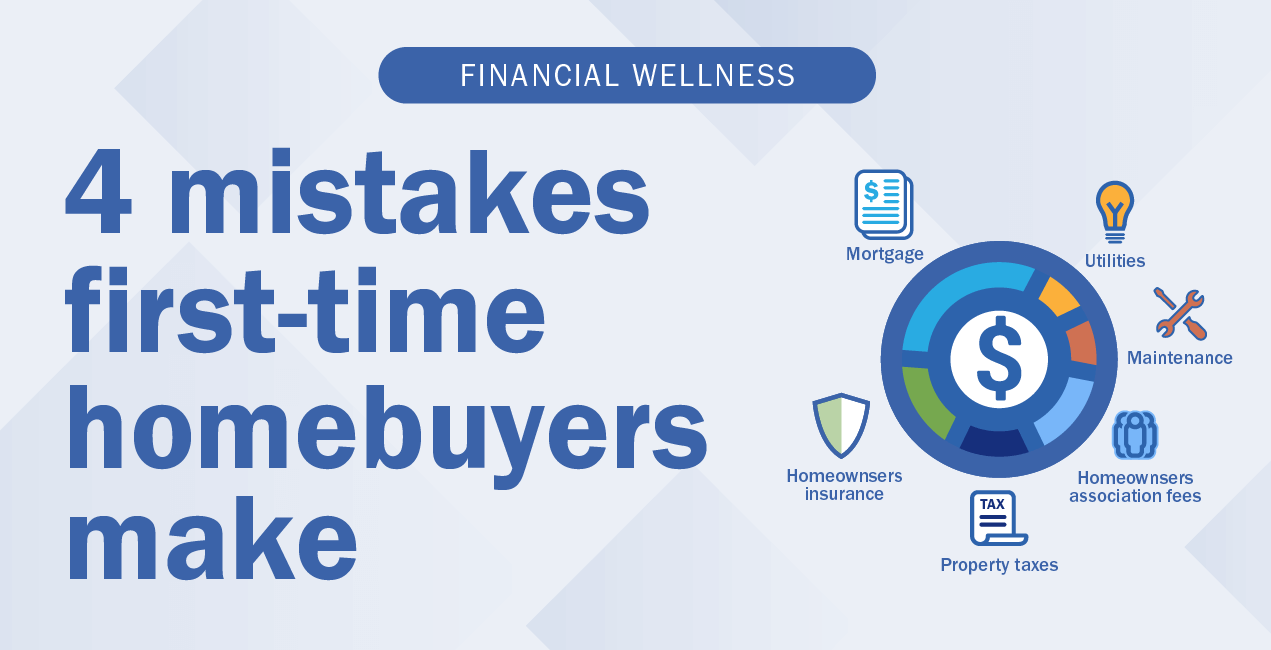

Infographic: 4 mistakes first-time homebuyers make

on November 10, 2025

| Home & Mortgage

Buying your first home is exciting, but it's easy to make costly mistakes. Here are some common pitfalls to avoid.

Read More

current_page_num+2: 3 -