Summer is the perfect time to refresh not just your home, but your finances too. Whether you’re gearing up for a vacation or enjoying a slower pace, use these warmer months to get a clearer view of your income, expenses, and goals.

Here are five actionable steps to help you boost your financial health and set yourself up for a more secure future:

1. Review your finances

Start by taking a close look at your income, expenses, debts, and financial goals. Track where your money is coming from and how it’s being spent. Are there areas where you can cut back? Are you on track to meet your short- and long-term goals, like paying off debt, building an emergency fund, or saving for retirement?

Reviewing your finances gives you a clear picture of your current financial health and helps identify areas for improvement.

2. Build a budget

Once you have a clear understanding of your finances, it’s time to create or revise your budget. List all sources of income and categorize your expenses, assigning a dollar amount to each category. Make sure to include essential expenses, discretionary spending, and savings.

There’s no need to start from scratch-there are many free budget templates available online, including Excel and Norton templates that can help you organize your finances. Prioritize paying yourself first by building savings into your budget. A realistic budget helps you stay on track and avoid overspending.

3. Prioritize debt repayment

If you’re carrying high-interest debt, focus on creating a plan to pay it down. Consider tackling the smallest balance first (snowball method) or the highest-interest debt (avalanche method) to build momentum and save money on interest.

Make extra payments whenever possible and avoid taking on new debt. Once one debt is paid off, roll those payments into the next one to accelerate your progress.

4. Start an emercency fund

Life is full of unexpected surprises, and having an emergency fund can provide a financial cushion. If you don’t already have one, start building your fund this summer. Aim to set aside 3-6 months’ worth of living expenses to cover emergencies like medical bills, car repairs, or job loss. Even small contributions can add up over time, and you’ll be glad you have the funds when you need them.

5. Broaden your financial knowledge

Use the summer months to expand your financial literacy. Read a personal finance book, listen to a money-focused podcast, or take a free or low-cost online course. Learning more about budgeting, investing, credit management, and saving strategies can empower you to make smarter financial decisions and feel more confident about your financial future.

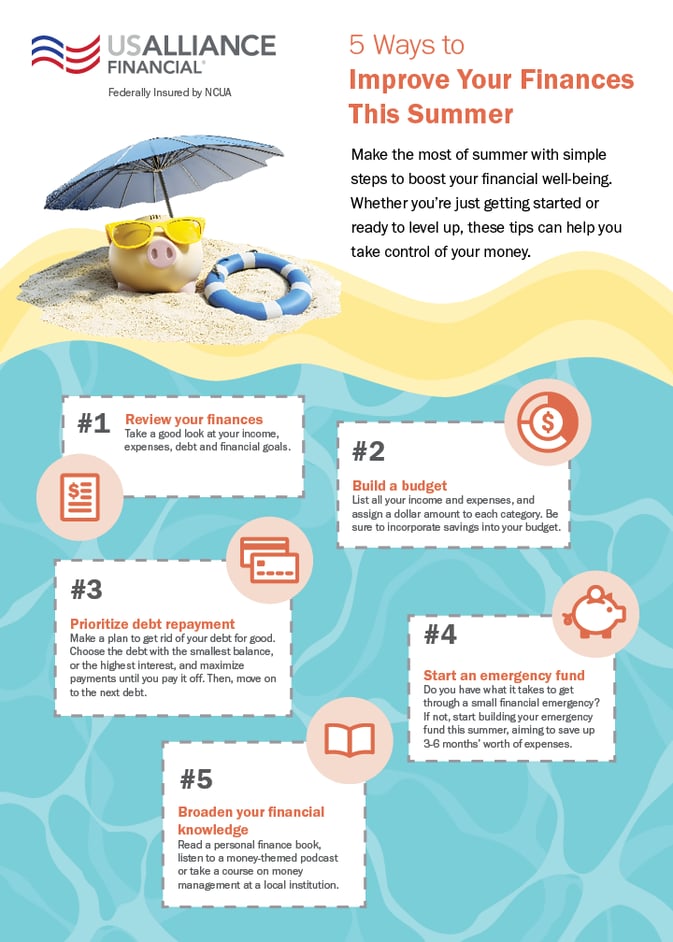

Take a look at our detailed infographic on improving your finances this summer!

Comments