What exactly is a data breach?

Let’s start with an example. In 2013 Target announced that nearly 70 million customers’ names, credit card numbers, expiration dates, card verification codes, mailing addresses, and email addresses had been hacked from their credit and debit card devices used during the holiday shopping period.

The 2013 Target incident is the best explanation of exactly what a data breach is — someone hacking into a secure system to steal all of your account information.

It’s considered to be a modern-day robbery of your cash and savings accounts.

How do you know if you're a victim of a data breach?

Most companies, like Target, will contact you via email or mail once they have verified that a data breach has happened. They will let you know what kind of information (name, credit card number, passwords) has been stolen or hacked.

Another option would be to watch your account for any fraudulent activity. Be wary of any emails you might receive announcing a new account opened in your name. The thief or hacker might be using information from the data breach to open new accounts that could go under the radar.

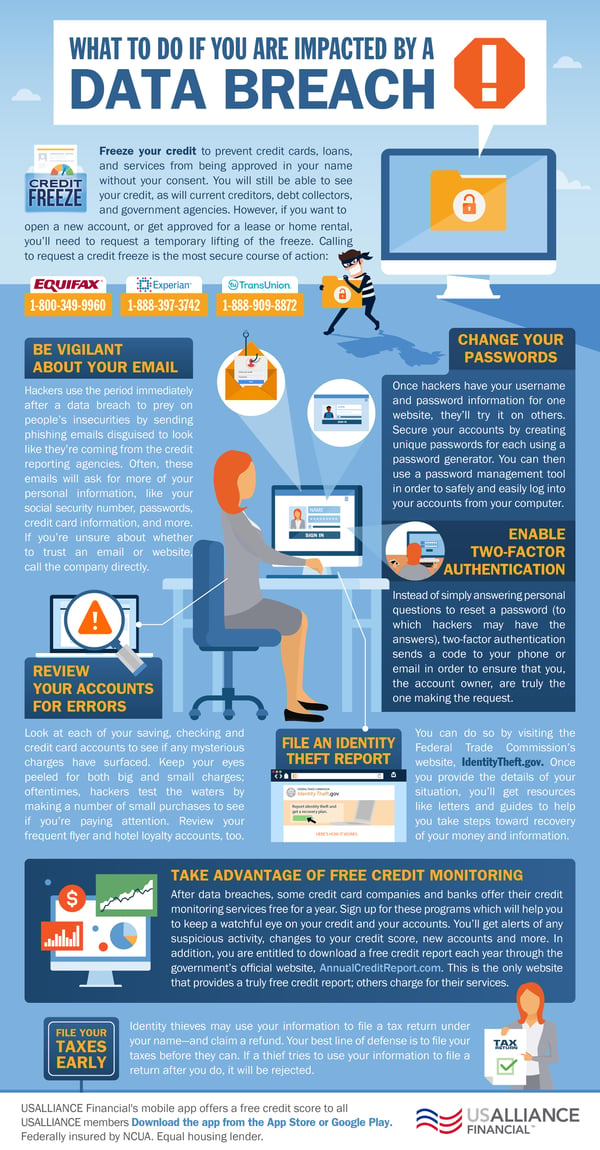

Once you’ve received information that a data breach has happened, here are the steps you can take to protect yourself and your accounts:

1. Change your account password.Usually, in a data breach, that is one of the first things that hackers steal. If you use the same password for any other accounts, you should change all of those passwords, too.

2. Contact your bank and credit card companies immediately.In the case of the Target data breach, Target contacted the compromised bank and credit card companies. But it doesn’t always happen that way. So get ahead of the thieves and call your bank and credit card company yourself. There might be time limitations for disputing charges. So the sooner, the better.

3. Place a fraud alert on your credit report.Contact any one of three credit bureaus: Equifax, Experian, or TransUnion. Once you contact one, they will contact the other two for you. Once a fraud alert is on your credit report, creditors are obligated to contact you before an account is opened in your name. These alerts are active for 90 day intervals.4. Request a credit report and review it for fraudulent activity.

Once you place a fraud alert on your credit report, request a report and look for any recently opened accounts. If there is any evidence of fraudulent activity, then consider placing a freeze on your accounts.

5. Freeze your credit at all three credit bureaus.Freezing your credit is considered to be one of the most effective ways to protect your credit. You can continue to use your credit cards as normal, even when your credit is frozen, but it will prevent hackers from opning any new lines of credit, even if they have your information. Keep in mind it costs $10 to freeze your credit at each bureau.

6. Monitor your account activity daily.Keep a close watch on any and all activity. If you see unauthorized activity or purchases, you can take action sooner rather than later.

If you’re looking for a safe and secure way to keep an eye on your accounts, our mobile banking app will provide you with a free monthly credit score and up to date account information. You can download it now on your Apple or Android device.

Comments