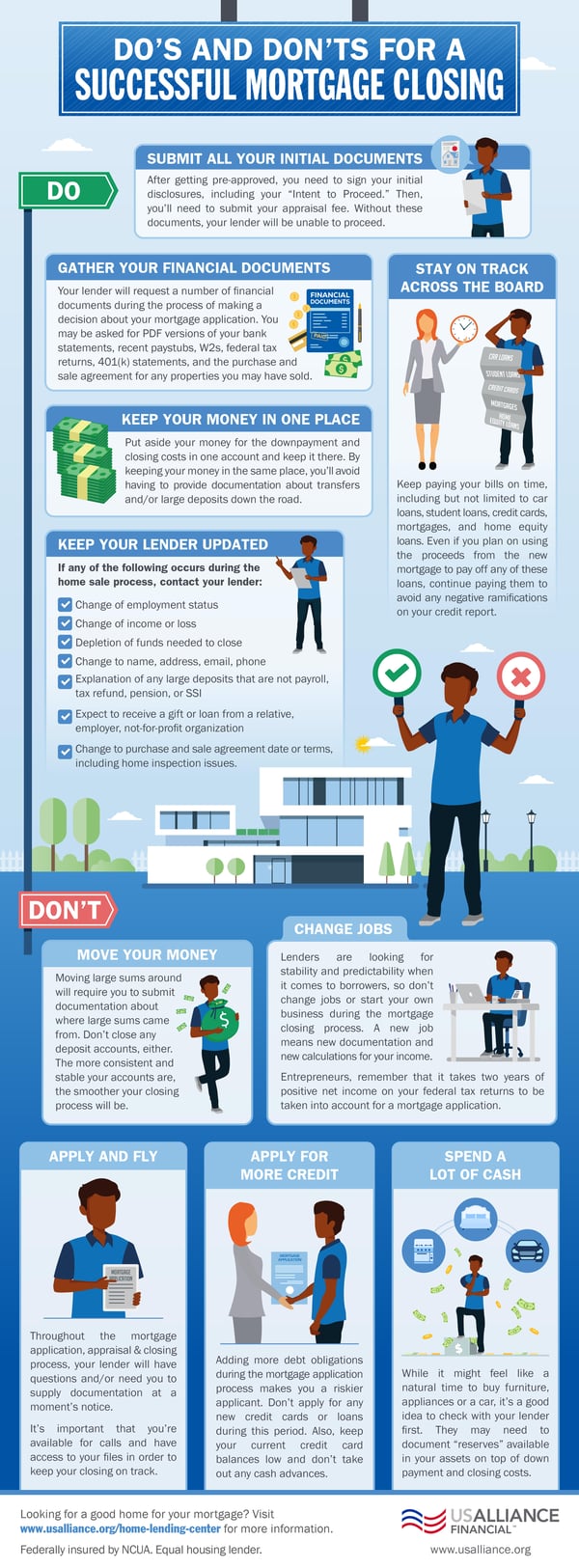

Whether you are purchasing your home or refinancing it, you'll want to keep the following do’s and don’ts in mind after you’ve applied with USALLIANCE for your closing to go as smoothly as possible.

DO:

1. Start the loan process off right!

After you’ve been pre-approved by USALLIANCE, and you’ve decided to move forward with us, please e-sign your initial disclosures, which includes the form called “Intent to Proceed” and send in the appraisal fee. Even if we have everything else requested for the mortgage, we won’t be able to continue processing your mortgage application if we don’t have the Intent to Proceed and Appraisal fee.

2. Get yourself organized.

Stay up to date with your online login credentials for your financial institutions in case new statements are required. Examples may include but are not limited to: PDF versions of your bank statements, recent paystubs, W2s, federal tax returns, 401(k) statements, and Purchase & Sale Agreement. You may want to consider using My Virtual StrongBox from USALLIANCE to help you stay organized during the loan process.

3. Stay on track.

Continue to make timely payments on all debt obligations including but not limited to car loans, student loans, credit cards, mortgages, or home equities. Even if the loan will be paid off from the proceeds of the new mortgage. It is better to be issued a refund for overpayment than to have a late payment show up on your credit report.

4. Be consistent.

Try to save the money needed for the down payment and/or closing costs to one deposit account. This should be the same account that you provided on the mortgage application and it will be the account that you use to obtain the certified check to bring to the closing table. This will help to avoid the moving money “don’t” listed below.

5. Keep us in the loop.

Notify your processor of any changes to your situation as they happen:

|

|

employment status (i.e. promotion, job loss) |

|

|

change of income or loss of income (i.e. change from salary to commission) |

|

|

depletion of funds needed to close |

|

|

change to current name, address, email, phone |

|

|

explanation of any large deposits that are not payroll, tax refund, pension or SSI |

|

|

expect to receive a gift or loan from a relative, employer, not-for-profit organization |

|

|

change to Purchase & Sale Agreement date or terms, including Home Inspection issues |

DON'T:

1. Move money.

Do not close any deposit account or move money between accounts. “Large deposits” that show up on your account statements will need to be sourced, exceptions made for payroll, tax refund, pension or SSI. That means more work for you as you will need to provide statements from the account where that money came from. And if that 2nd statement has large deposits too, then we’ll need a statement from that 3rd account as well, and that will keep going until all large deposits have been sourced.

2. Change jobs.

If possible, please do not change jobs or start your own business! Especially if we need your bonus income to qualify you for the mortgage. A new job means new documentation and new calculations for your income. Since your first paystub can be delayed, you’d want to hold off on the job change if you can. Also, we can only use base salary to qualify you on a new job; so, sign-on bonuses, regular bonuses or commission income are no longer included. And if it’s a new business you’re starting, we’d need a two-year history of positive net income showing on your federal income tax returns.

3. Apply and fly.

Please do not go on vacation or leave the country after the appraisal has been completed. Your application goes into review at that stage and your underwriter may have follow up questions or need additional documentation for the final approval. You’ll want to be available for calls or emails and have access to your files. If not, your closing will be delayed.

4. Open new credit.

Do not open new credit cards, max out or take cash advances on current credit cards or obtain new loans after you’ve applied for the mortgage. The new debt will show up on your “refresh” credit report (pulled prior to closing) and may prevent you from obtaining the mortgage if your debt-to-income ratio has increased beyond our lending guidelines. It may be tempting to buy new furniture, appliances or a car before you move or improve, but you’ll be better off waiting.

5. Spend a lot of cash.

If you decide to use your own funds for these new purchases instead, please check with your processor as we may need to document “reserves” available in your assets on top of the down payment and closing costs. Reserves are funds in an account totaling at least two months’ worth of housing expenses. Depending on the loan scenario it could be up to 12 months.

Have you found financing for your dream home?

Comments