The holiday season is over and your bank account, may be experiencing a sense of remorse. All of that gift giving comes at a price, one that may have your wallet feeling a bit light.

Does this sound familiar? Read on for a few tips to get you back on track financially in 2022. (Bonus: we’ll help you avoid getting into the same spending trap next year with a few simple preparation strategies.)

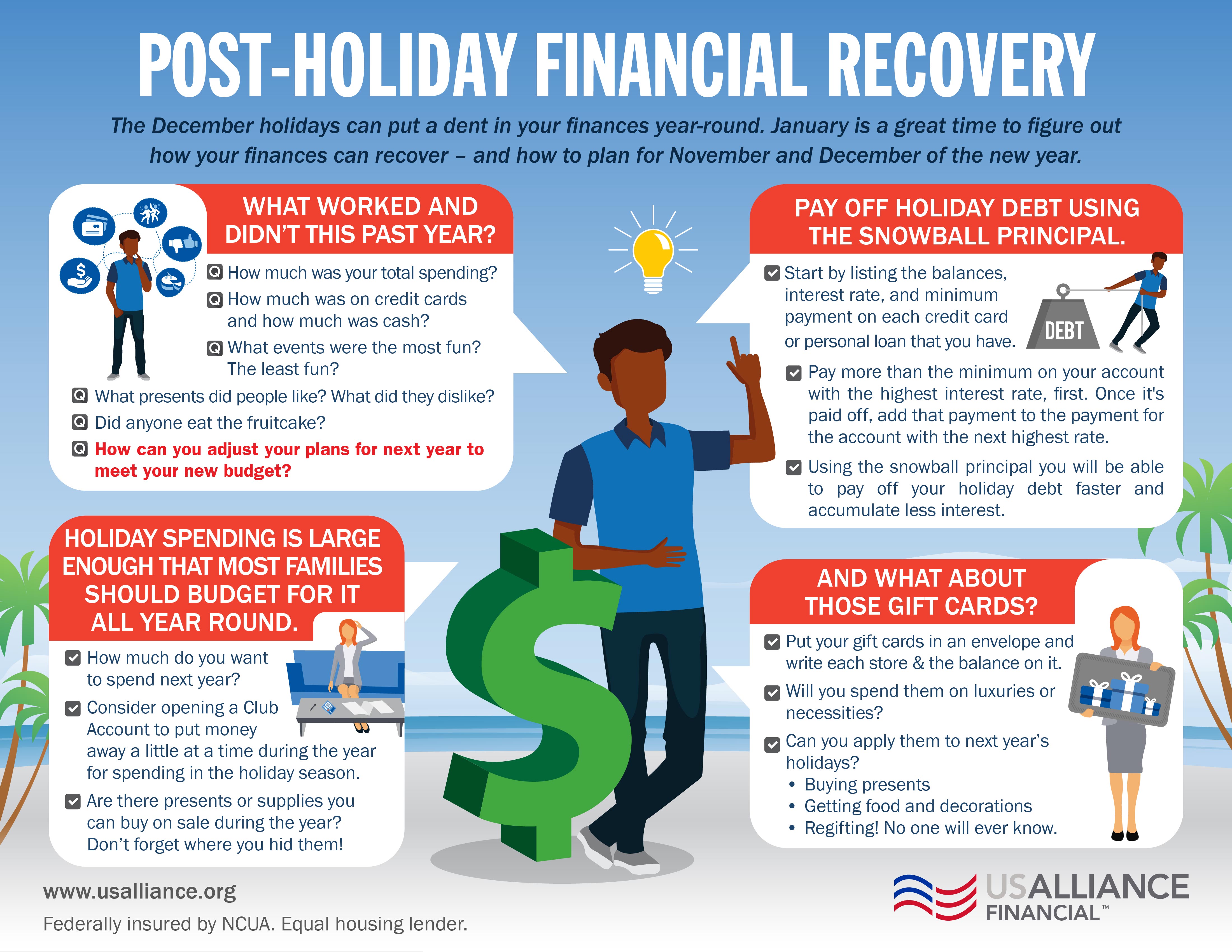

Do a holiday post-mortem

Before getting into even more debt as the new year begins, it’s important to take a look back on your spending habits this past holiday season. What worked? What didn't work? Take some time to calculate how much you spent in total. Evaluate how much you paid in cash and how much was purchased on credit cards. Make note of gifts that you know people loved versus gifts that received a lukewarm reception.

In addition to gifts, think about what else you spent money on over the holiday season. New outfits for festive functions? Tickets on outdoor events? Food, drink, and decorations? Tally up your expenses and think about which ones were "worth the expense" and which you could do without in the future.

Create an action plan for next year

After you have a good idea of how much you've spent on holiday gifts last year, you’ll be in a better position to create a budget for this year. Will you spend more or less in 2021?

According to the National Retail Federation, consumers plan to spend an average of $967 for decorations, candy, and gifts during the holiday season. That's a pretty large chunk of change. This year avoid the holiday debt cycle and think about opening a Club Account - an account that lets you set aside small amounts of money throughout the year. By Thanksgiving, you’ll be ready for those Black Friday sales!

Bonus tip: if you know you’ll need more decorations, supplies, gift wrap, or other seasonal items next holiday season, purchase them now while stores are trying to eliminate their festive inventories. Buying these items on sale may mean spending in the short term, but they’ll save you money in the long run.

Snowball any debt away

If you’ve accumulated any debt over the holidays (or in general), you’ll save money on interest by paying them down using the debt snowball strategy:

- Begin by listing out each account’s balance, interest rate, and minimum monthly payment.

- Pay the minimum amount on each card, but try to pay as much as you can above the minimum payment toward the card with the highest interest rate.

-

Work your way backward until all of your cards are paid off in full.

Put those gift cards to work!

Did you receive any gift cards over the holidays? Rather than spending them all right away or leaving them to collect dust, create a plan to use them wisely.

Begin by listing out each retail location and the value of each card. Also keep in mind that some gift cards do have an expiration date, so be sure to make a note of this. Then, decide if these cards can be put toward necessities, luxuries, or if you can save them for next holiday season. Cards that fall into the third category can be stored away for now and used for gifts or as gifts later in the year - just don't forget where you've put them!

Comments