One of the most fundamental and important parts of financial education is learning the language that is commonly used in the financial world. It can be overwhelming to discuss or even think about and research finances on your own without having a basic grasp of the terms that you will come across. Without knowing what APR is, you can’t make an informed decision on which credit card would be the best fit for you. Without knowing what a Certificate of Deposit, or share certificate, is you can’t know all the possible options you have for growing your savings.

Knowledge is power, and that is especially true when it comes to finance. By learning some essential financial definitions, you open up a whole new world of financial education for yourself. When you have the basics down, you can delve into more and more advanced financial education topics and resources because you will have the knowledge necessary to understand them. Download the full infographic at the bottom of the page to learn the meaning of some common financial terms.

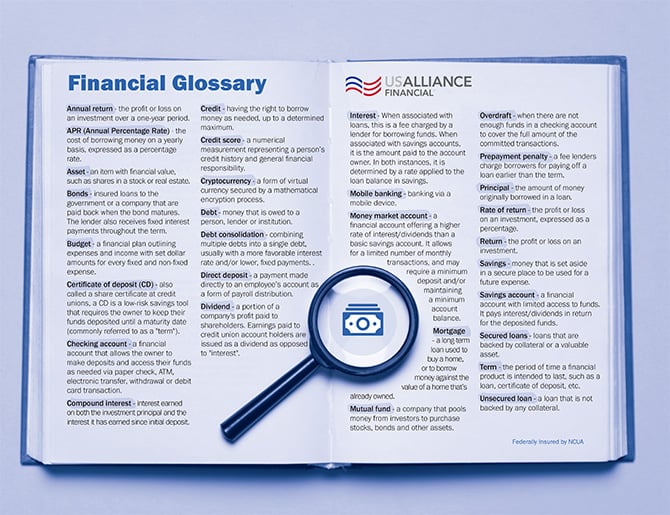

Financial Glossary

-

Annual return – the profit or loss on an investment over a one-year period.

-

APR (Annual Percentage Rate) – the cost of borrowing money on a yearly basis, expressed as a percentage rate.

-

Asset – an item with financial value, such as shares in a stock or real estate.

-

Bonds – insured loans to the government or a company that are paid back when the bond matures. The lender also receives fixed interest payments throughout the term.

-

Budget – a financial plan outlining expenses and income with set dollar amounts for every fixed and non-fixed expense.

-

Certificate of deposit (CD) – also called a share certificate at credit unions, a CD is a low-risk savings tool that requires the owner to keep their funds deposited until a maturity date (commonly referred to as a “term”).

-

Checking account – a financial account that allows the owner to make deposits and access their funds as needed via paper check, ATM, electronic transfer, withdrawal or debit card transaction.

-

Compound interest – interest earned on both the investment principal and the interest it has earned since initial deposit.

-

Credit – having the right to borrow money as needed, up to a determined maximum.

-

Credit score – a numerical measurement representing a person’s credit history and general financial responsibility.

-

Cryptocurrency – a form of virtual currency secured by a mathematical encryption process.

-

Debt – money that is owed to a person, lender or institution.

-

Debt consolidation – combining multiple debts into a single debt, usually with a more favorable interest rate and/or lower, fixed payments.

-

Direct deposit – a payment made directly to an employee’s account as a form of payroll distribution.

-

Dividend – a portion of a company’s profit paid to shareholders. Earnings paid to credit union account holders are issued as a dividend as opposed to “interest”.

-

Interest – When associated with loans, this is a fee charged by a lender for borrowing funds. When associated with savings accounts, it is the amount paid to the account owner. In both instances, it is determined by a rate applied to the loan balance in savings.

-

Mobile banking – banking via a mobile device.

-

Money market account – a financial account offering a higher rate of interest/dividends than a basic savings account. It allows for a limited number of monthly transactions, and may require a minimum deposit and/or maintaining a minimum account balance.

-

Mortgage – a long-term loan used to buy a home, or to borrow money against the value of a home that’s already owned.

-

Mutual fund – a company that pools money from investors to purchase stocks, bonds and other assets.

-

Overdraft – when there are not enough funds in a checking account to cover the full amount of the committed transactions.

-

Prepayment penalty – a fee lenders charge borrowers for paying off a loan earlier than the term.

-

Principal – the amount of money originally borrowed in a loan.

-

Rate of return – the profit or loss on an investment, expressed as a percentage.

-

Return – the profit or loss on an investment.

-

Savings – money that is set aside in a secure place to be used for a future expense.

-

Savings account – a financial account with limited access to funds. It pays interest/dividends in return for the deposited funds.

-

Secured loans – loans that are backed by collateral or a valuable asset.

-

Term – the period of time a financial product is intended to last, such as a loan, certificate of deposit, etc.

-

Unsecured loan– a loan that is not backed by any collateral.

Comments