Tax season is fast approaching, and you might already be thinking about getting everything ready to go. It’s great to start organizing well in advance of the deadline to avoid any last-minute issues, but it can be overwhelming. That’s why USALLIANCE has put together this helpful guide to assist you in getting ahead on your taxes. Here’s how to prepare for tax season.

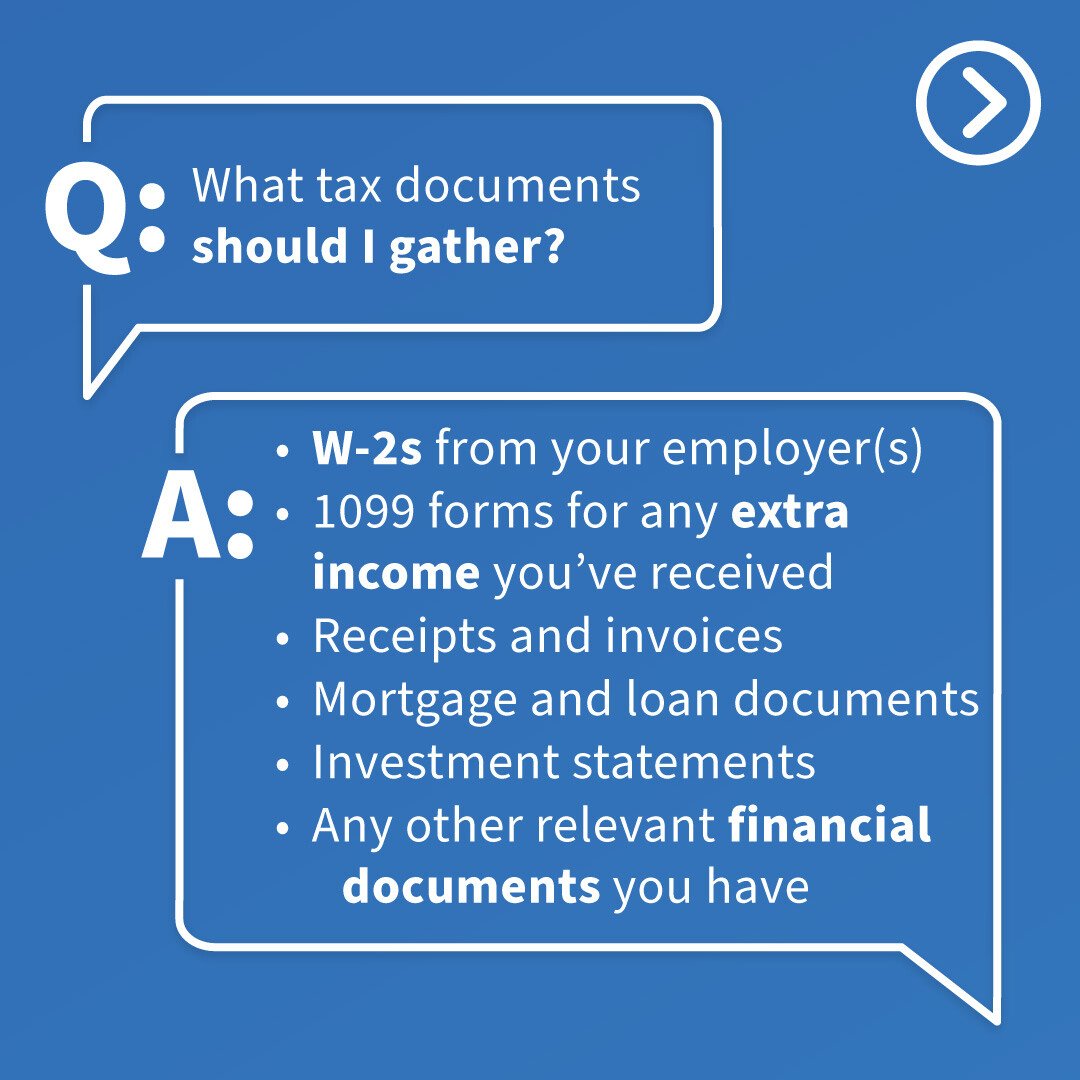

Gather Your Documents

The first step in prepping for tax season is to gather all the necessary documents. No matter if you’re filing your taxes yourself or hiring a professional, you will need certain information and documentation to file your taxes. Depending on your personal circumstances, these can include:

- W-2 forms

- 1099 forms

- Receipts and invoices

- Mortgage and loan documents

- Investment statements

- Business income and expenses

- Other miscellaneous income

It’s not necessary but having last year’s state and federal tax returns on hand can also be helpful. It can help remind you of what you filed last year and which documents you needed to do so. Additionally, most tax return software providers will allow you to upload last year’s tax return to pre-fill some information and save you time.

Organize Your Finances

This step in preparing for your taxes is one that you might have been doing all throughout the year, but if not, there’s still time to get your finances organized before filing your taxes. Store all your physical documents and receipts in a folder or binder, and any electronic records in a digital file so you can access them whenever necessary. This will help ensure you don’t miss any deductible expenses.

Getting your paperwork and digital documents ready for this tax season is likely the highest priority right now if your finances are not organized. Once your taxes are filed, though, consider setting up a system to use for the rest of the year. By setting it up ahead of time and making it easy for yourself, it’s more likely that you will stick to your system all year and make filing your taxes next year a breeze.

Prepare Your Personal Information

In addition to your income information, you’ll also need personal information on hand to file your taxes or to have a professional do them for you. Last year’s taxes can help with this, as they will include a lot of the personal information that you will need to provide this year, as long as the information is the same.

You will need the Social Security numbers and/or tax ID numbers and date of birth for yourself , your spouse, and each dependent you claim. Remember that dependents can include elderly parents and others in addition to children. Having this information prepared before you begin can save a lot of time and hassle in filing your taxes.

Review Changes in Tax Law

The tax code changes every year – and this year more than most – so bringing yourself up to speed on the latest changes in tax law is always an important part of tax season. Tax codes can be complex and confusing, and that’s one reason that some people are not informed when they file their taxes, but that can lead to lost savings or bigger issues. There are plenty of free, easy-to-understand resources online, or your tax professional can help explain this year’s changes to you, so there’s no need to feel overwhelmed. Some of this year’s modifications may impact your tax situation. Be sure to review the most recent updates so you can take advantage of any new deductions or credits.

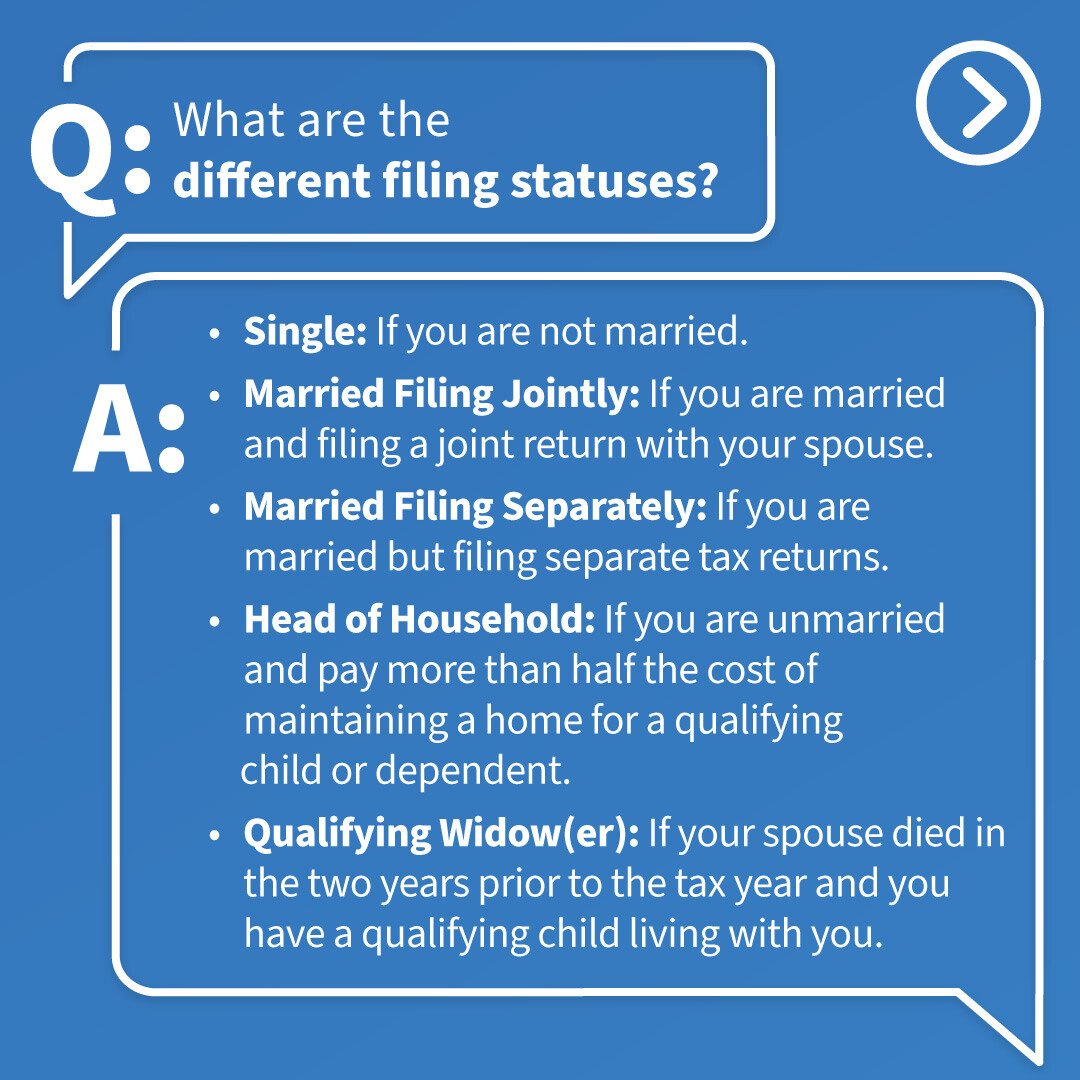

Determine Your Filing Status

Choosing your filing status for your taxes is very important. It determines your filing requirements, appropriate tax rate, the standard deduction you’re eligible to take, and your eligibility for certain credits. Information you’ll need includes marital status, spouse’s year of death (if applicable), and the percentage of the costs that your household members paid toward keeping up your home. Choose the status that best fits your situation. The most common filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Learn the Deadlines

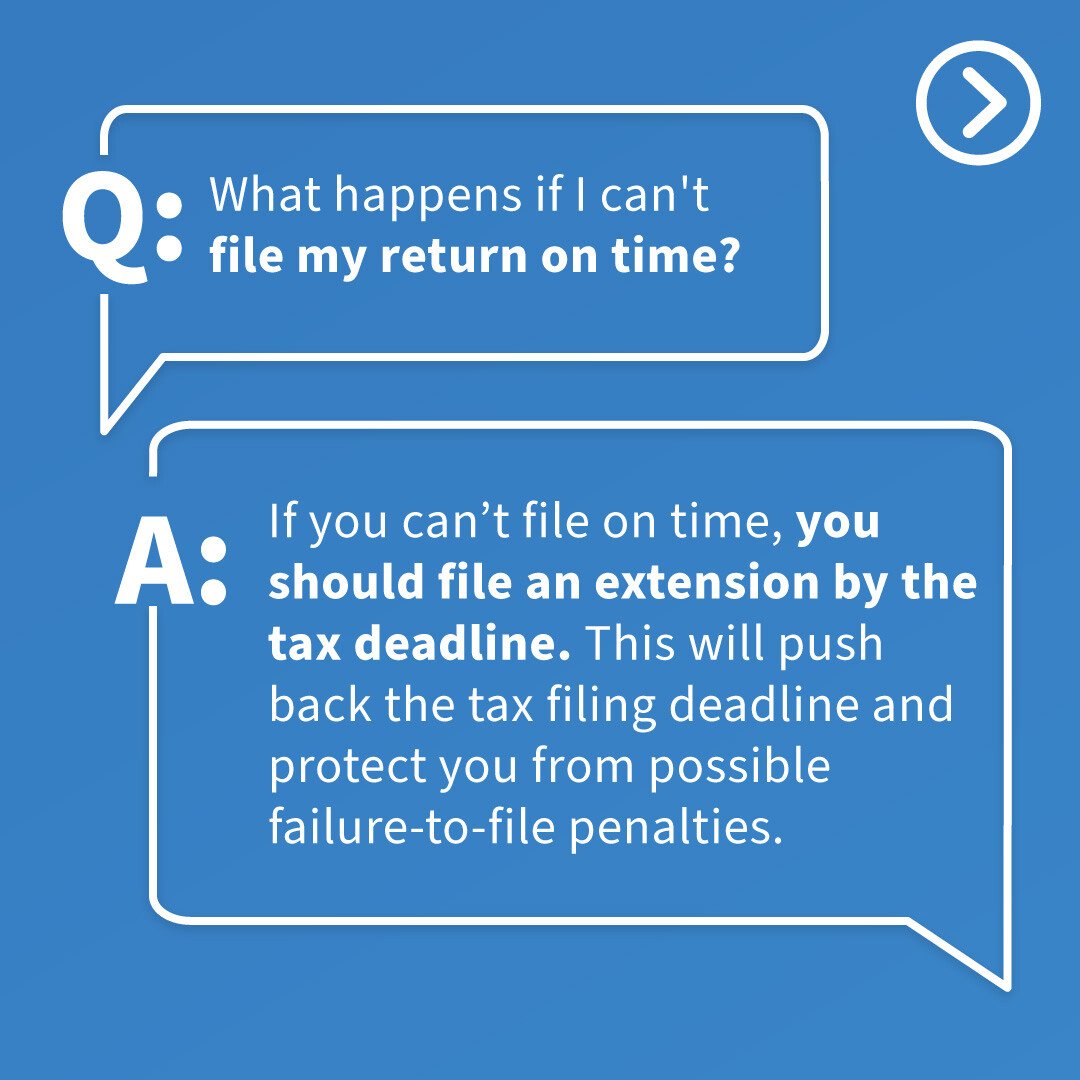

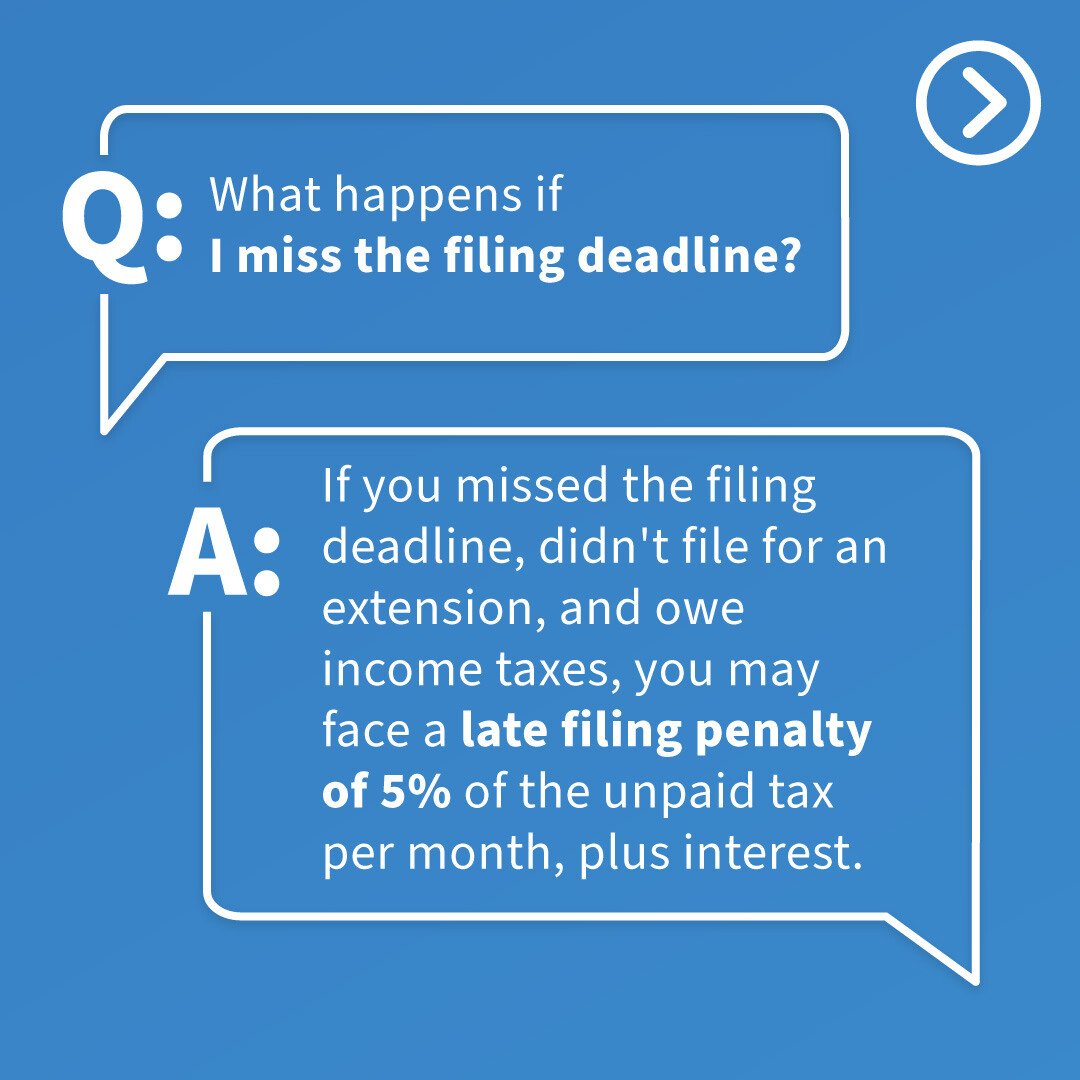

One of the most important parts of filing your taxes is getting them in on time, so it is vital to be aware of tax filing deadlines. For most individuals, the deadline to file federal income taxes is April 15th. In years when the 15th falls on a weekend or holiday, the deadline is typically extended to the next business day. You can also apply for an extension on the deadline to file your taxes, however it should be noted that this does not grant you any extension of time to pay your taxes. If you cannot meet the deadline, visit www.irs.gov or consult your tax professional as soon as possible to determine your options for an extension.

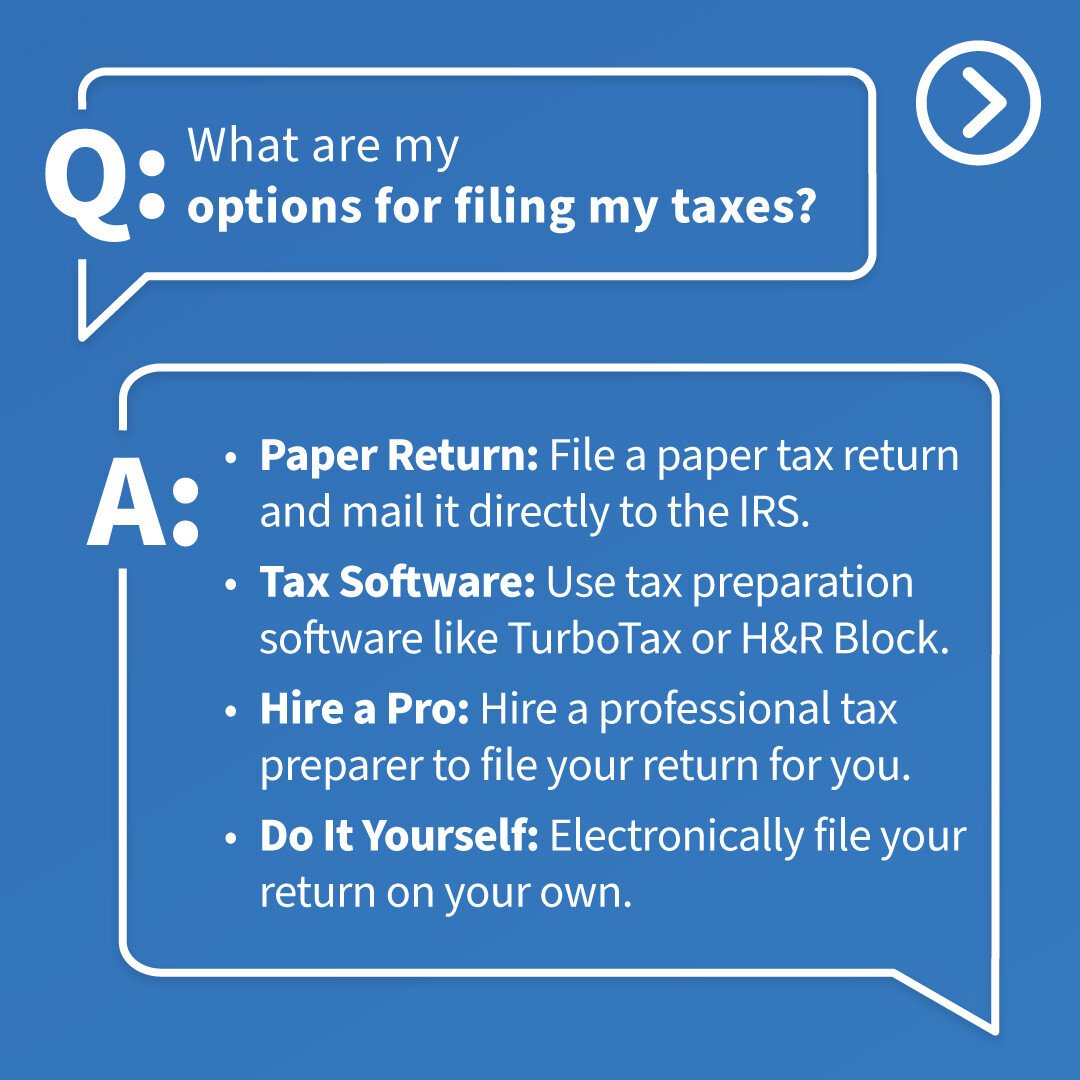

Choose Your Filing Method

These days, there are plenty of options to file your taxes:

- Paper Return: File a paper tax return and mail it directly to the IRS.

- Tax Software: Use tax preparation software like TurboTax or H&R Block.

- Hire a Pro: Hire a professional tax preparer to file your return for you.

- Do It Yourself: Electronically file your return on your own.

The best method of filing your taxes depends entirely on you – do you feel comfortable filing your own taxes? Do you want to save money on filing your taxes? Do you want to save time filing your taxes? Maybe you just don’t want the hassle and would prefer a professional to handle everything for you. Whatever the case may be, choose the filing method that fits you best.

Plan for Next Year

Finally, use the tax season as an opportunity to plan for the future. If you received a large tax return check, maybe you want to lower your tax withholdings and get more money in each paycheck. If you received no return or even owed the government more money, then you might want to consider increasing your tax withholdings so you’re not writing the IRS another check next year. As previously mentioned, this is also a good opportunity to get your finances organized and set up a system to use all year. Think of how smoothly tax season will go next year when you have all your documentation ready to go.

Tax season is not a season many people look forward to. It can be a stressful time with documents to gather, law changes to understand, and deadlines to meet. While it can feel overwhelming, with this guide, you should be all ready to file your taxes this year – and maybe even get ahead on next year too.

Comments