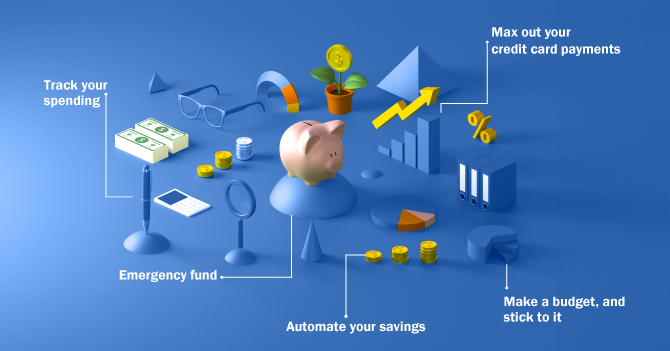

Having New Year’s resolutions centered around finances is very common, and for good reason. There are few aspects of life that financial wellness doesn’t affect, so prioritizing your financial health is a great place to start your new year. This infographic touches on five financial resolutions to set you on the path to financial wellness for 2024:

Track your spending

Use a spreadsheet, a classic pen and paper, or a budgeting app to make it easier.

Keeping tabs on your spending is a vital aspect of your financial health. How you track your spending doesn’t matter nearly as much as the fact that you’re doing it. If you’re savvy with a spreadsheet, you might be comfortable creating your own budget tracker. If you’re more old-school, a simple pen and paper should be sufficient to keep a record of your purchases. If this all sounds like a hassle to you, there are plenty of budgeting apps like Mint or YNAB that can help make it easy. If you’re a USALLIANCE member, check out our spending analysis tool in digital banking to help you get a handle on where you’re spending your money.

Make a budget, and stick to it

You can designate separate amounts for every spending category, use the 50/30/20 budget or try the envelope system.

Without a goal in mind, it’s easy to let spending spiral out of control. That’s why you need to create a budget that works for you and stick to it! There are a lot of different budgeting methods out there to try, such as the 50/30/20 budget or the envelope system, so find the one that suits you best.

Max out your credit card payments

Take steps toward freeing yourself from credit card debt by adding an extra $50, $100, or whatever you can afford to your monthly payments.

Getting out of debt is perhaps the most important thing you can do for yourself financially in 2024. Take steps toward freeing yourself from credit card debt by adding more to your monthly payments – regardless of if that’s an additional $100, $50, or less, every little bit will help you kick your credit card debt faster. If you need further relief, a debt consolidation loan or a balance transfer to a card with a lower interest rate could be a good option.

Build an emergency fund

If a single unexpected and large expense will send you spiraling into debt, start building an emergency fund to protect yourself.

If a single unexpected and large expense will send you spiraling into debt, start building an emergency fund to protect yourself. Start out small and try to save up a month’s worth of living expenses as a buffer. Ideally, you should have enough money to cover 3 to 6 months of living expenses in your emergency fund, but you can build that up over time. Your budget will help you figure out what you need each month to cover food, housing, bills, and other essentials.

Automate your savings

Make saving simple by setting up an automatic monthly transfer from your checking account to your savings account.

Part of the battle with saving money is simply remembering to set some of it aside. It’s easy to get caught up with rent, bills, and other expenses to the point that you forget all about your planned monthly saving. Make saving simple by setting up an automatic monthly transfer from your checking account to your savings account. You might not even miss the money in your checking account if it’s transferred automatically, making it that much easier to save!

Comments